Contents

- 1 What is Stripe Payment Gateway for Shopify?

- 2 What is the Checkout Conversion Rate On Shopify?

- 3 Why Checkout Conversion Rates Drop on Shopify?

- 4 Best Practices to Maximize Conversions with Stripe on Shopify

- 4.1 Enable Express Checkout Options

- 4.2 Offer the Right Payment Methods for Your Audience

- 4.3 Optimize for Mobile Checkout First

- 4.4 Reduce Payment Failures with Smart Payment Handling

- 4.5 Use Built-In Fraud Protection Without Overblocking Customers

- 4.6 Keep the Checkout Experience Clean and Trustworthy

- 4.7 Monitor Performance and Optimize Continuously

- 5 Real-World Impact: How Stripe Helps Shopify Stores Grow

- 6 Conclusion

There has been an explosion in online businesses in the past few years. When an increasing number of customers started to make purchases over the phone and on their laptops instead of going to the physical outlets, entrepreneurs followed suit. Starting out with an online store is no longer the reserve of large brands; anyone with a product and a thought can start one today.

And as far as the selection of the content management system (CMS) or eCommerce platform is concerned, one of the most popular choices is Shopify. Admittedly, other options are available, yet Shopify can be distinguished due to its simplicity, scalability, and the speed with which businesses can be founded and turned into a live store without struggling with cumbersome technical configurations.

Nonetheless, the development of a Shopify store is just halfway. The actual struggle starts at checkout. This is the place where most of the store owners become trapped – particularly when deciding on the appropriate payment gateway. Shopify Payments, Stripe, PayPal, third-party gateways – there can be an overwhelming number of choices.

Businesspeople tend to pose themselves the question:

- Is it better to use Shopify Payments, or will Stripe be a more appropriate choice to improve checkout performance?

- Will my customers trust it?

- Will it decrease cart abandonment?

These questions are important because simple problems at checkout could result in lost sales. Here, we will understand how the Stripe payment gateways affect Shopify checkout conversion and why many thriving merchants continue to use Stripe to make their payment experience quicker, easier, and more efficient.

What is Stripe Payment Gateway for Shopify?

In case you have an online store hosted on Shopify, the payment gateway is the mechanism that makes money flow. It is the one that safely stores the details of customer payments, interacts with the banks, and makes transactions run easily.

Stripe is a payment gateway that is heavily used around the world, serving companies of both small and big businesses.

Stripe, in its simplest form, enables Shopify merchants to take and handle online payments on their store without redirecting their customers to third-party pages.

Why Stripe Is a Big Deal in Online Payments

Stripe operates as a worldwide payment solution that provides more than standard payment processing services.

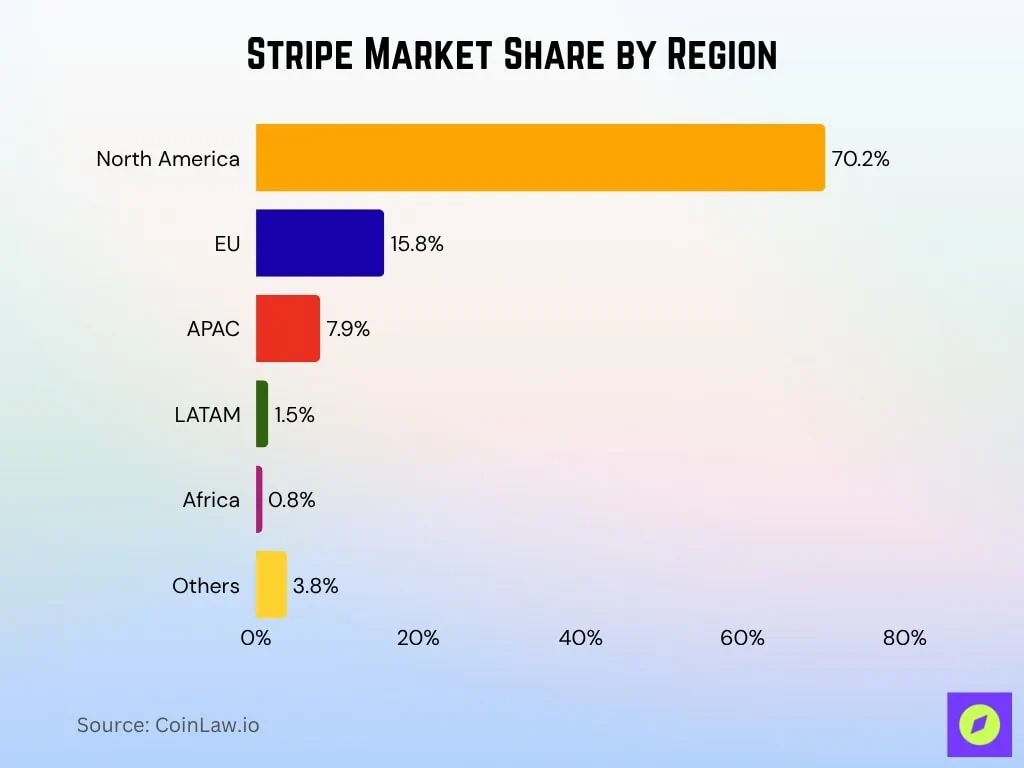

Source: CoinLaw

The company’s global presence can be understood through these facts about its operations:

- Stripe processes over $1 trillion in payment volume annually

- Millions of businesses across 100+ countries use Stripe

- The system manages multiple transactions, which range from hundreds to millions, during Black Friday and Cyber Monday peak sales periods

- Major brands such as Amazon, Shopify, Google, and Zoom rely on Stripe’s infrastructure

The system needs this capacity because payment systems require high reliability to ensure successful checkout processes. The gateway enables customers to complete their checkout process when it manages high traffic together with international cards and complex payment flows, without any errors.

How Stripe Works with Shopify

- Shopify merchants depend on Stripe for their payment processing needs more than most people understand.

- The backend operation of Shopify Payments is powered by Stripe.

- The payment service Shopify Payments provides merchants with a simplified payment solution that uses Stripe technology under the Shopify brand.

- Merchants can use Stripe as their third-party payment gateway solution in locations where Shopify Payments does not operate.

The payment processing system operates through Shopify Payments when users choose that option, while using direct Stripe integration.

Stripe enables Shopify merchants to access advanced payment processing features that are typically found in enterprise systems, yet remain easy to use, thus making it a suitable option for businesses that want to grow and improve their checkout procedures.

What is the Checkout Conversion Rate On Shopify?

Now that we know Stripe is a popular and dependable payment gateway, the next thing to figure out is what we actually want to improve.

This is the point where the checkout conversion rate really matters. Simply put, the Shopify checkout conversion rate shows how many people actually finish buying something after they begin the checkout.

It shows the percentage of visitors who move from “I’m ready to buy” to “Order confirmed.”If your store gets a lot of visitors and has good products, but people aren’t completing their purchases, it means you’re losing sales right at the last moment.

Here’s an easy example to get a handle on checkout conversion. Let’s take a simple example to explain it.

- 1,000 shoppers put products into their carts.

- 400 of them go ahead and check out.

- Only 200 people have finished the payment so far.

Here, your checkout conversion rate would be 50%. The shoppers who didn’t stick around didn’t leave due to your product itself – they walked away because something went wrong or they felt uneasy during the checkout process.

What is a “Good” Checkout Conversion Rate on Shopify?

Checkout conversion rates can change depending on the industry, where you are, and the type of device people use, but usually,

- Around 40% to 50% is usually seen as average.

- A range of 50% to 60% is pretty solid.

- Getting over 60% is great and usually comes from having a smooth checkout and payment system that works without issues.

The nearer your store is to the top of this range, the fewer sales slip away at the last step, and the more value you squeeze out of each visitor.

Why Checkout Conversion Rates Drop on Shopify?

When a shopper gets to checkout, it means they’ve already made up their mind to buy. When a sale falls apart at this point, it’s usually not because of the product itself.

Usually, checkout conversion rates fall because buyers run into friction, get confused, or don’t feel trust while finishing their purchase. Even little problems can make someone hesitate, and that hesitation is often enough for a customer to walk away from their purchase.

Here are some of the main reasons why Shopify stores often have trouble getting people to complete their checkout.

Complicated or Time-Consuming Checkout Flow

Shoppers want the checkout to be fast and easy. If the process drags on or requires too much info right away, users tend to rethink whether they want to go through with it.

When checking out feels like a hassle, people are more likely to give up, especially when they’re using their phones.

Limited or Missing Payment Options

Not all customers want to pay in the same way. Some people like using cards, while others stick to digital wallets or local payment options. If their choice isn’t there, they might just leave without finishing the checkout.

Payment Failures and Declined Transactions

There’s nothing more annoying than when you try to pay for something, and the transaction just doesn’t go through – even though there’s enough money and all the details are right.

Checkout conversion rates drop when people find the process confusing, slow, or complicated. If there are unexpected costs, too many steps, or limited payment options, customers tend to give up before finishing their purchase. Poor mobile experience or security concerns can also make folks hesitate to complete checkout.

Lack of Trust and Security Signals

Checkout is the part of shopping where people feel the most cautious. If customers don’t trust how their payment information is managed, they just won’t want to take the chance.

Poor Mobile Checkout Experiance

A lot of traffic on Shopify comes from mobile devices, but many stores still have trouble making the mobile checkout process smooth.

Common mobile issues include things like slow performance, battery draining quickly, apps crashing, screen freezing, and problems with connectivity. If the checkout process isn’t easy on a mobile device, customers will just leave and go somewhere else.

Unexpected Costs at the Final Step

Seeing a hidden cost, such as conversion rates, shipping costs, etc., at checkout can quickly make someone change their mind about buying.

When customers think the final amount is different from what they expected or aren’t ready for it, they’re much more likely to walk away.

Technical Errors During Checkout

Even stores that look good on the surface can have backend problems that slow down the checkout process. These problems might not always be easy to see, but they have a direct effect on whether a payment goes through or not.

Checkout conversion rates on Shopify don’t fall because customers suddenly stop caring. They drop because something goes wrong exactly when it matters most. Most problems, like payment failures, missing choices, and trust worries, come down to how payments are handled and presented.

Best Practices to Maximize Conversions with Stripe on Shopify

Using Stripe on Shopify isn’t just about accepting payments. It’s about setting up the checkout so it’s smooth, trustworthy, and makes it easier for more customers to finish buying.

When you set up Stripe the right way, it can do more than just handle payments in the background – it can actually help improve how well your checkout works. Shopify merchants can get the best results from Stripe and boost their checkout conversions by sticking to these simple best practices.

Enable Express Checkout Options

Speed matters at checkout. Many shoppers abandon a purchase simply because the process takes too long. Stripe supports express checkout methods that allow customers to complete payments with minimal effort. To improve conversions:

- Enable Apple Pay and Google Pay

- Make express buttons visible early in checkout

- Allow returning customers to pay without re-entering details

Fewer steps mean fewer drop-offs, especially on mobile devices.

Offer the Right Payment Methods for Your Audience

Stripe enables Shopify merchants to support various payment methods that match their customers’ different payment preferences.

The best practices include these guidelines:

- Supporting major credit and debit cards

- Enabling digital wallets for faster checkout

- Adding local payment methods for international customers

Shoppers display higher purchase confidence when they encounter a payment method that they recognize.

A business should design its website to function best during mobile checkout.

Optimize for Mobile Checkout First

Shopify receives most of its traffic from mobile devices. Merchants must create mobile-friendly websites because the Stripe checkout process requires them to maintain mobile usability standards.

To enhance mobile conversion rates, businesses need to implement these improvements:

- Test the entire checkout flow on mobile devices

- Ensure payment buttons load quickly

- Forms should not include any additional fields that serve no purpose

The complete process of mobile payments leads to increased rates of customers finishing their purchases.

Reduce Payment Failures with Smart Payment Handling

Stripe has an advantage in terms of the possibility to increase the rate of payment success. Merchants must capitalize on this by setting up payment settings appropriately.

Key steps include:

- The payment retries should be enabled.

- Enabling smart acceptance features in Stripe to do authorization logic.

- Observing reduced transactions and correction patterns at an early stage.

The number of failed payments decreases, and so does the number of frustrated customers and the number of orders being completed.

Use Built-In Fraud Protection Without Overblocking Customers

Security is essential, but overly aggressive fraud filters can block genuine buyers. Stripe’s fraud detection tools help strike the right balance.

To achieve high conversions:

- Automate fraud detection rules instead of manual ones.

- Check blocked payments on a regular basis.

- Set risk levels to suit your store history.

This makes sure that real customers do not get turned away at the checkout.

Keep the Checkout Experience Clean and Trustworthy

Customers are largely influenced by the element of trust when making payments. The checkout process at Stripe allows secure and professional payment experiences that ensure buyers feel safe about it.

Best practices include:

- Ensuring distraction-free checkout pages.

- No unnecessary redirects.

- Good security payment signs.

The clean checkout creates trust and makes customers go through with their purchase.

Monitor Performance and Optimize Continuously

The conversion optimization is not a single job. Shopify merchants are expected to analyze payment data on a regular basis to detect areas of improvement.

Focus on:

- Checkout abandonment rates

- Payment failure trends

- Device and region-based performance

By making the right insights, you are able to adjust your Shopify Stripe integration to match the customer behaviour and optimise the outcomes in the long run.

Stripe, when implemented well on Shopify, is not merely one that handles payment; it actually helps convert more customers at checkout. Merchants can convert more checkout visits into a successful order by prioritizing speed, flexibility, trust, and reliability without altering their products or their marketing strategy.

Real-World Impact: How Stripe Helps Shopify Stores Grow

In the case of Shopify merchants, the real growth can be achieved by correcting what is silently halting the sales. The influence of Stripe is felt in the day-to-day processes – the increased ease of checkout, the decreased number of payment problems, and a system that will continue functioning as the business grows.

Rather than manifesting as a visible characteristic, Stripe enhances the purchasing process in aspects that the customers will only realize that nothing has gone wrong.

Minimizing Wastes By Reducing Lost Sales At Checkout.

Among the most direct effects of Stripe, one can distinguish reduced revenue loss because of payment failures. One declined card can prevent a sale. Stripe is effective with 5-10 percent more successful transactions in Shopify stores that are configured accordingly.

How Stripe helps:

- Retries of failed transactions were automatic and would not require any customer action.

- Eliminates false declines using intelligent acceptance algorithms.

- Monitors and flags high-risk payments and permits genuine ones.

This will ease the checkout process and create confidence in the customer, leading them to make a repeat purchase.

Dealing with Traffic Jams Easily

Rushing events, such as Black Friday, Cyber Monday, or product release, have the potential to overload payment systems with resultant slowdowns or failures. The Stripe infrastructure is designed to support huge traffic, and therefore, lost sales during peak times are avoided.

For instance, with the help of Stripe and its scalable payment infrastructure, a clothing store was able to handle more than half a million transactions in just a Black Friday sale without going offline.

Using Stripe, merchants do not need to fear that they will lose revenue due to demand spikes.

3. Supporting International Growth

Stripe makes cross-border payments complex easier than Shopify stores, which aim to sell around the world. The transactions made between countries tend to fail because of currency problems or other unknown local payment systems, but Stripe provides the means to break those obstacles.

Example: When a European Shopify cosmetics brand expanded to North America and Asia, the international checkout completion surged by 12 percent due to the provision of local payment options through Stripe.

With the international shoppers, stores will be able to increase their market without introducing technical complications.

Creating Customer Long-Term Trust

Constant, stable, and safe payments enhance brand perception. Shoppers will shop again when they get a fast and secure checkout, thus enhancing lifetime customer value.

How Stripe supports trust:

- Safe money transfer with fraud insurance.

- Professional checkout design.

- Reduces the occurrence of mistakes that irritate customers.

Trust also helps in minimizing the chances of disagreements or a refund, saving merchants time and money.

Conclusion

Shopify merchants can maximize revenue without having to increase traffic and spending more on marketing by optimizing checkout conversions, which is one of the most effective methods to do so. Stripe payment gateways have a critical role in the process as they offer a quick, trusted, and safe checkout experience, exceeding the expectations of modern customers.

In addition to payment processing options, Stripe has made the dealings with various payment options easier, and it takes the actual hitches, including payment failure and the ability to conduct transactions across borders, quite subtly but very important to the successful purchase of a product or service.

Stripe also creates trust on checkout in addition to technical reliability. To Shopify vendors seeking to achieve maximum sales and scale-to-scale, integrating Stripe is not a solution that is merely a payment-related option; it is a business tool turning the checkout into an engine of growth.

Finally, by emphasizing speed, flexibility, security, and trust, Shopify businesses can leverage Stripe to make the checkout experience not just a potential bottleneck but a competitive edge, making sure that a greater number of visitors become paying customers and allowing growth to become sustainable over time.