Gold has been the most sought after of the planet’s precious metals since prehistoric times, famous for both its financial and cultural value.

It hardly matters whether the gold trading behaves like a bull or a bear. Due to its distinct position in the global economic and social environments, the investment in gold bullion offers exciting and lucrative liquidity opportunities to all investors.

While the majority invests and keeps the metal outrightly, bullion traders operate in equity and options markets, allowing them to leverage its potential with calculated risks.

The trading of yellow metal isn’t that tough. It’s just that the process requires skill sets and an understanding which is unique to this commodity. If you are a greenhorn in this industry, or you’ve just started, or maybe it’s been a while, and you’re struggling to connect the dots, the following four steps will help you to create a stable and sustainable gold portfolio:

- How Does Gold Move:

As one of the oldest and most trusted currencies globally, gold is established deeply into the social and economic psyche. Everyone holds an opinion about it, however, the yellow metal responds only to specific price catalysts. Each of these parameters split down the middle in polarity and effects the volume, sentiments, and trade intensity.

There’s a possibility of elevated risk when the bullion traders act on one of these polarities:

- Deflation and Inflation

- Fear and Greed

- Supply and Demand.

Singly or a fusion of these forces are always in play in global markets, forming long-term patterns that track uptrends and downtrends equally.

- Understanding the Investors:

The most sought after metal interests a varied range of stakeholders with diverse and often conflicting interests. Institutional investors indulge in massive hedging activity by buying and selling in grouped bonds and currencies through bilateral strategies, popularly known as risk-on and risk-off.

There are retail participants too who are a big chunk of the population of gold bugs. This category has limited funds and often prefer staying long-term with the precious metal.

Gold bugs add massive liquidity while possessing a floor under gold and futures stocks. It is because they provide a constant supply of buying interest at lower prices. They also assist in giving significant entry for the short-sellers, particularly in dynamic markets, when one of the three fundamental forces polarizes favoring strong buying pressure.

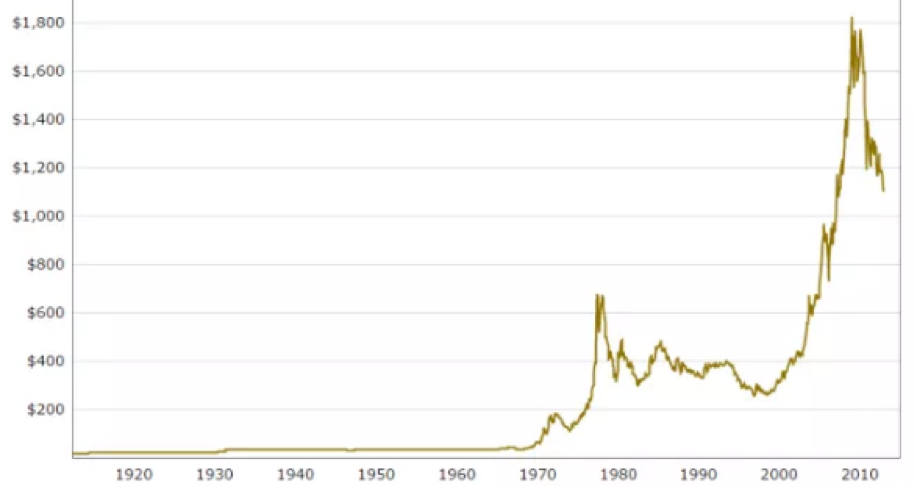

- Clarity About The Long-Term Chart:

Efforts invested in understanding and learning the gold chart inside-out with a 100-year history goes a long way. Though there have been trends that continued for decades, the metal has also slipped down for incredibly long periods restricting profits at large.

Strategically, this analysis would help to identify price levels that need constant supervision if and when the metal returns to test them.

Liquidity is directly proportional to gold trends. It shoots up when the metal rises and vice-versa. This oscillation has a greater impact on future markets than equity markets due to lower average participation rates.

There are several gold trading options available to bullion investors in the UK including but not limited to:

- Gold Coins and Gold Bullion

- Gold Certificates

- Gold Futures

- Gold ETFs [Exchange Traded Funds]

Conclusion:

Gold is perceived to be a safe-haven asset for investors. It can also similarly behave when you have approach the market with the right tools and strategies. Like other markets, bullion market too favours the brave with a calculated, planned, and a stable mindset.

From an eagle’s eye view, there are four steps to trade gold profitably:

- Learn to decode the chemistry between the three polarities that impact the bullion markets.

- Get acquainted with varied psyches that focus on hedging, gold trading, and ownership.

- Learn to evaluate the long and short-term gold charts focusing on key price levels.

- Select your risk-taking venue based on high liquidity and easy trade execution approach.