Contents

Living in a technology-driven world, we have seen major disruption across all the industries, whether it is logistics, travel, hospitality, food or baking, and financial.

A few years back, Fintech was limited as it only offered the selected services such as money management, savings, investments, and few more. But now with the advent of Artificial Intelligence and Blockchain, more opportunities are emerging that provide robust solutions as well as enhancing customer experience.

AI and Blockchain’s penetration in the Fintech industry is quite witnessed by its applications. Below are some of the applications that include the algorithms of AI, such as-

- Digital financial advisor

- Easy transaction search

- Fraud prevention

- Secured and authorized payments

- Facial recognition authentication

- Easy malware detection, etc.

So let’s discuss in detail how AI and Blockchain offer quality services to customers at cost-effective rates and revamping the Fintech industry efficiently.

#1 Automated & Enhanced Customer Support

Customer experience is quite important these days because customers are becoming smarter due to social media and wide usage of the Internet. In the same way, AI-powered chatbot allows financial institutions to serve the customers in a better and personalized way. With the penetration of chatbots, customer information and their queries can be accessed in real-time.

AI-enabled chatbots can be used by the Fintech industry to assist customers and acknowledge them about their balance, transaction, and other related information. Well-known chatbots like Eno and the Cleo interact with customers round the clock and answer their queries.

It cut down the administrative cost and helped customer assistants serve a number of customers together. One of the London based reports stated that automatic replies through chatbot cut down 22% of operating costs and improve customer satisfaction ratio at the same time.

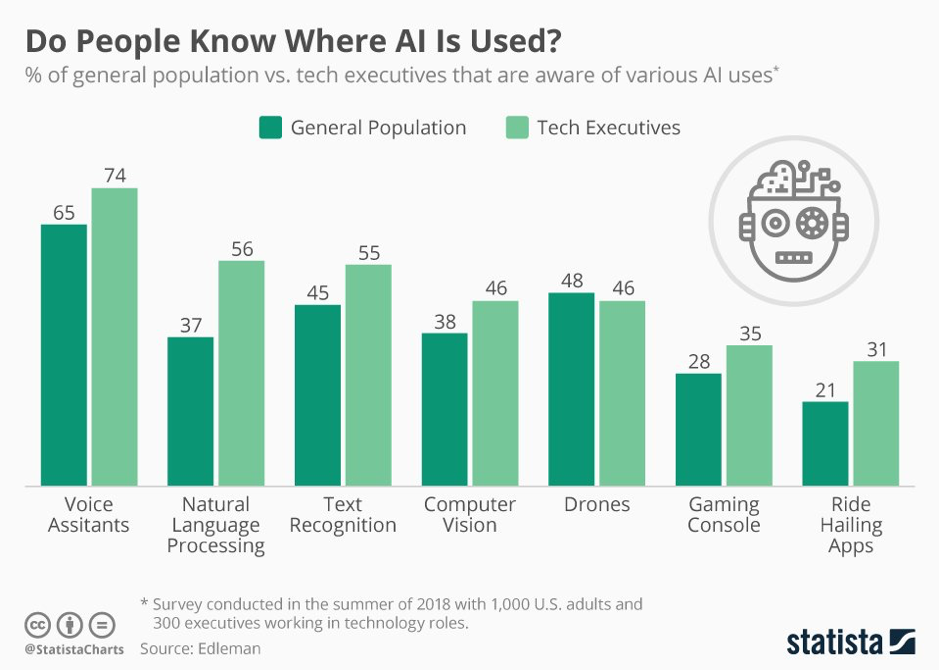

You can see in the above graph, how AI is making its way in different segments so it is clear that if banking and financial institutions want to improve customer service, AI has to be involved.

#2 Fraud Prevention

This is the second important way AI is reshaping the Fintech industry. Earlier, banks and financial institutions lacked smart technology, thus, it was difficult to prevent fraud activities.

But today smart technologies are meant to deliver seamless customer experience and prevent fraud activities. Keeping in this mind, more and more banking institutions are investing in AI technology to detect fraudulent transactions. AI and Blockchain solutions are strong enough to detect fraud in real-time and can analyze the data quickly without any error.

Here we should not forget that along with banking and finance, the human resource is another sector that is highly affected by AI and its solutions. Even a large organization also implements an advanced cloud based payroll solution that allows them to handle a large volume of employees data with ease.

According to the recent study, financial institutions are more vulnerable to threats and becoming a victim of data theft. But AI solutions are capable of identifying frauds and enhancing general compliances. Thus, we can see that fintech is the right industry where the power of AI and its capabilities are used in an effective manner.

#3 Algorithmic Trading

When it comes to trading, people are afraid as no one wants to lose their hard-earned money into the stock market. Thus, researches said that investing money in stocks can be risky if you lack smart and predictive skills. A large investment portfolio requires a smart system while making trading decisions.

It also requires an in-depth analysis that allows customers to make smart and safe investments. Here AI algorithm helps investors in predicting future market trends and make decisions based on that. Moreover, with the help of AI algorithms, financial managers can also observe market trends. Thus, it can be said that AI does not only automate the process but help individuals and investors to make intelligent decisions.

Blockchain In Fintech

Blockchain is a much-hyped buzzword in the digital currency market these days and everyone from business owners to individual stock players is talking about it. A blockchain is a type of decentralized ledger for maintaining a record in chronological order.

As blockchain is a highly secured place to store the data, the Fintech industry is embracing this technology to make people trust them and develop secure financial products.

How Blockchain Revolutionizing Fintech Industry

The main purpose of deploying blockchain solutions to the fintech industry is to create a seamless and comprehensive customer journey which will later result in a reduction in costs that are still borne by traditional banks. It ensures safety and eliminates the inefficiency of the baking and financial sector. Moreover, it also satisfies the needs of modern customers and private clients.

Blockchain technology uses different cases in financial services such as –

- Smart contracts

- Digital payments

- Digital identity

- Smart stock market transactions

Along with security, it will also reduce the financial loss and cyber-attack rates. After embracing blockchain solutions, now baking institutions can safely store and exchange the data within the decentralized networks.

Concluding Words

With the increasing usage of mobile technology in recent years, Fintech is growing as well as appreciated rapidly in the market. It also stated that Fintech is taking advantage of all the emerging technologies that automate the financial system and offer efficiency in transactions.

On the other hand, blockchain technology is still in its infant stage and abilities are being explored, it is important to research and stay connected with the new trends to make the best of these two technologies and how it is disrupting the Fintech operations.