Contents

Using a SecureSpend or Prepaid gift card makes money transfers and daily transactions simple. This Visa gift card, which cannot be reloaded, functions like a prepaid credit card and is widely available at various retailers across the USA. It offers a secure and convenient way to shop online or in stores without sharing personal information with merchants.

The Secure Spend card doesn’t incur any costs for online purchases and provides numerous benefits, including making payments and shopping online. It also protects your identity by not disclosing personal details or your social security number.

However, before enjoying its benefits, the card must be activated. Activation is crucial for privacy and secure transactions. Users can access all card features without registration or approval from the bank. The activation process is quick and convenient, allowing users to check their initial balance and track remaining balances after purchases.

Individuals can enjoy multiple benefits every time they shop using the SecureSpend card, including the ability to use various payment methods for a single purchase. With its robust security features and customer-friendly facilities, the SecureSpend card is among the best options for secure transactions.

Benefits of Secure Spend Visa Prepaid Card

1. Expense Tracking: One of the key benefits of the Secure Spend card is its ability to track expenses effectively after the initial purchase. Users can easily monitor their spending habits and manage their finances more efficiently.

2. Privacy Protection: The Secure Spend card prioritizes the privacy of users’ personal information. By using this card, individuals can conduct transactions without the need to disclose sensitive personal details, enhancing their privacy and security.

3. Ease and Security: The card offers a seamless and secure experience, ensuring that customers can enjoy the safest services and engage in practical activities such as bill payments and online shopping with peace of mind.

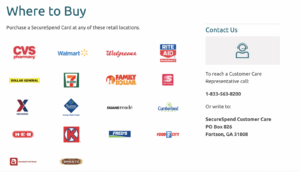

4. Accessibility: Obtaining and using the Secure Spend card is simple and convenient. It is readily available at numerous retail locations across the USA, making it easily accessible to a wide range of users.

5. Enhanced Security: The Secure Spend card provides an added layer of security to its users. It safeguards personal information and ensures secure money transfers, offering users peace of mind regarding the safety of their funds and sensitive data.

6. User-Friendly: The card is designed to be user-friendly, catering to the diverse needs of its users. With its intuitive interface and accessible features, users can easily navigate and utilize the card whenever they need it.

How To Use Secure Spend Prepaid Visa Gift Card Online

1. Check Card Balance: Before making any online purchase, verify that the balance on your SecureSpend card is sufficient to cover the transaction amount, including any applicable taxes.

2. Choose Payment Option: When prompted to select a payment method, choose either the “Credit” or “Debit” option, depending on the options provided by the online merchant.

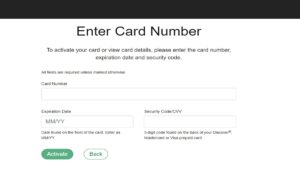

3. Enter Card Details: Input the necessary credit or debit card details of your Secure Spend card in the designated payment method section. This typically includes the card number, expiration date, and security code.

4. Provide Billing Address: Enter your name and address in the “Billing Address” field. This ensures that the billing information associated with your Secure Spend card matches the information provided during the online transaction, minimizing the risk of payment issues or fraud.

How to Check Secure Spending Card Balance Online

To check your initial balance after making a purchase using a Secure Spend card, you can follow these steps to check your balance online:

1. Navigate to the official Secure Spend website by visiting the following link: https://www.securespend.com/.

2. Enter your card number accurately into the designated space provided on the website’s homepage.

3. Input the expiration date of your SecureSpend card as indicated on the card itself.

4. Proceed by clicking on the green “Sign In” button displayed on the webpage.

5. Once you’ve successfully signed in, the website will display all relevant information regarding your balance and recent transactions directly on the screen.

Read Also:- Petco Credit Card Login And Apply Step By Step Guide 5 Easy Steps

Step By Step Login To Securespend.com

1. Open the web browser on your device and ensure you have a stable internet connection.

2. Navigate to the login page provided by Secure Spend. This page is typically found on the official SecureSpend website or through the Secure Spend mobile app.

3. Once you’ve reached the login page, you’ll be prompted to enter your email address associated with your Secure Spend account. Ensure that you input the correct email address to proceed.

4. After entering your email address, proceed by typing in your secure password in the designated field. Make sure to enter the password accurately to avoid login issues.

5. Optionally, you may choose to check the “Remember Me” box on your device if you want the browser to remember your login credentials for future logins. This step is recommended only if you are using your personal device.

6. Once you’ve entered your email address and password and checked the “Remember Me” box if desired, click on the login button to access your SecureSpend Card account.

7. If you happen to forget your password, don’t worry. You can retrieve or reset it directly from the login page by following the provided instructions or clicking on the “Forgot Password” link.

How to Activate SecureSpend Visa Card Online

1. First, when prompted to choose between credit or debit options during activation, select the appropriate option using the keyboard provided. This step ensures that your card is activated for the correct type of transactions.

2. Next, you’ll need to log in your name on the receipt to proceed with the activation process. This step may involve entering your personal details or confirming your identity to verify the activation.

3. If you intend to use your card for debit transactions, you’ll be prompted to choose and input a Personal Identification Number (PIN) for that card. This PIN adds an extra layer of security to your transactions, ensuring that only authorized users can access and use the card for debit transactions.

4. After completing the activation process, it’s essential to recheck your total balance on your card. Transactions made using your card, such as money transfers or purchases, may trigger deduction costs, including standard fees, tax charges, and more, which will be deducted from your account balance.

5. One of the advantages of the SecureSpend Card is its ability to support multiple payment methods for a single purchase. This flexibility allows users to choose the most convenient payment method for each transaction, whether it’s credit, debit, or another payment option.

6. Lastly, when using your SecureSpend Card for payments, it’s advisable to inform the merchant about this type of payment. This ensures that the merchant is aware of the transaction and helps prevent any issues or disruptions that may occur if the card is not recognized or accepted.

Conclusion

Secure Spend Card offers users a secure and convenient way to manage their finances and make purchases online and in-store. With its prepaid Visa gift card functionality, users can enjoy the benefits of a credit card without the need for a traditional bank account. The card prioritizes privacy and security, protecting users’ personal information during transactions. Additionally, the card’s activation process is simple and quick, allowing users to access its features promptly. Overall, the SecureSpend Card provides a reliable and accessible payment solution for individuals seeking flexibility and security in their financial transactions.