Contents

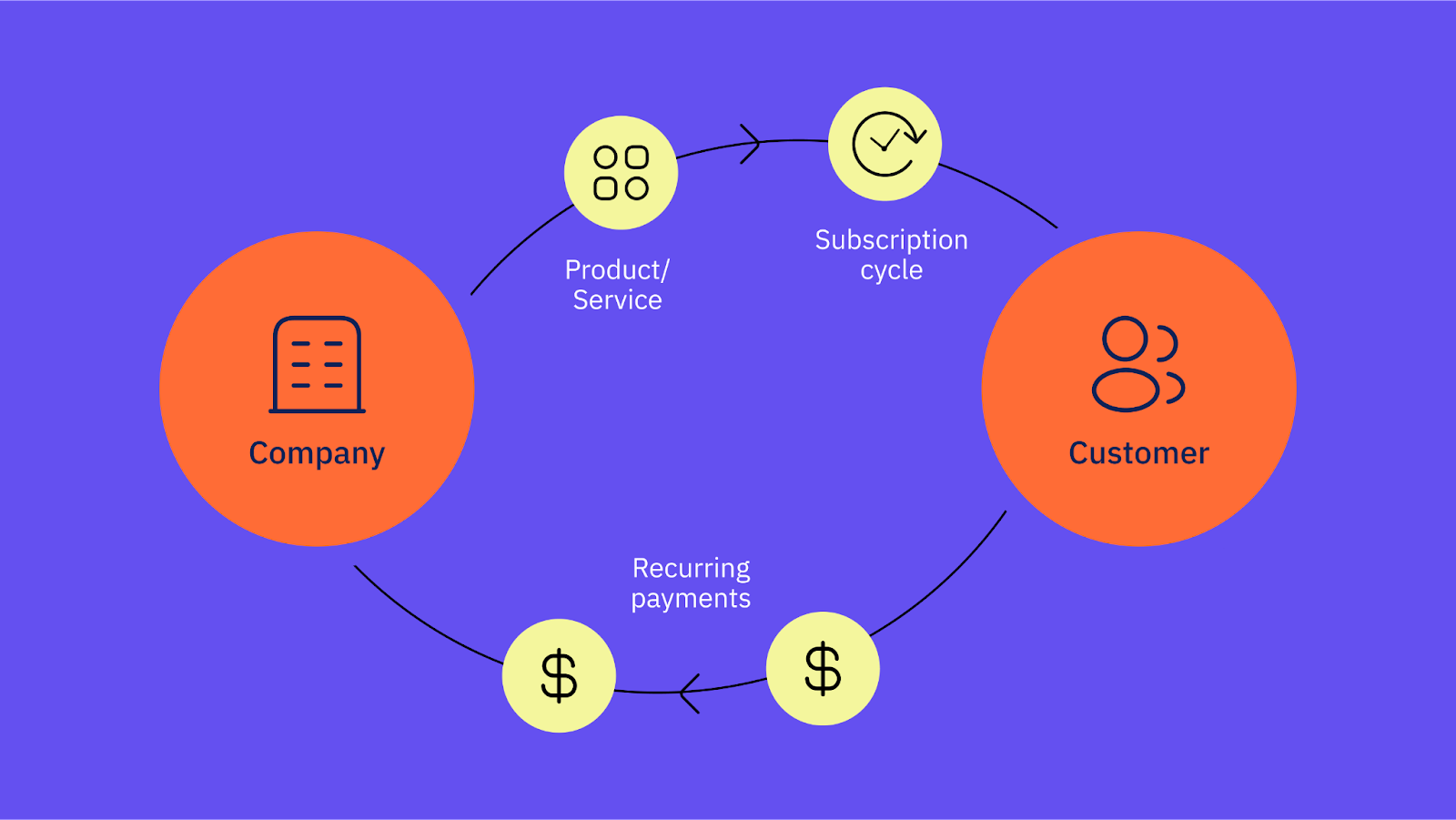

In modern financial transactions, recurring payments have emerged as a game-changer, offering convenience for both businesses and consumers alike. Subscription payments, also referred to as recurring payments, are automatically deducted from a customer’s bank account or credit card regularly. Recurring billing can be used to set up these payments at whatever frequency the client and the company decide.

At its core, a recurring payment system is designed to automate regular payments, providing a seamless experience. This article delves into recurring payments’ definition, types, and benefits, highlighting its significance in today’s dynamic business landscape.

Defining Recurring Payments: A Seamless Financial Solution

Recurring payments are automatic, prearranged transactions in which clients give permission for a service provider to take money on a recurring basis. This system, also known as autopayments or regular payments, streamlines financial processes for businesses and customers.

Recurring billing services are financial solutions that let companies automatically invoice their clients for goods or services they provide regularly. By automating the payment process, this solution guarantees a smooth and hassle-free transaction for the company and its clients.

Types of Recurring Payments

Most companies that use recurring payments operate on a subscription basis, giving clients the freedom to select the length and frequency of their subscriptions and the option to cancel or renew them whenever they’d like.

- Fixed Recurring Payments: In this type, a consistent amount is deducted at regular intervals, suitable for subscription-based services.

- Variable Recurring Payments: The amount varies based on usage or consumption, common in utility bills or pay-as-you-go services.

Benefits for Businesses

The first step in a subscription model is to set up a recurring payment mechanism. These three tips will help you succeed with recurring payments, no matter what you sell. For business owners, recurring payments have other advantages as well, including:

- Consistent Cash Flow: For businesses, recurring payments ensure a steady and predictable cash flow, aiding in financial planning and stability.

- Efficiency: Automation reduces the manual workload, allowing businesses to focus on core operations rather than chasing payments.

- Customer Retention: Subscription-based models foster long-term relationships, increasing customer loyalty.

Benefits for Customers

Customers find auto-pay, which automatically deducts the pre-arranged subscription price for your business services, to be convenient. They can concentrate on the experiences and value that your company provides because they won’t have to worry about making payments. Additional advantages for clients with recurring payments include:

- Convenience: Consumers benefit from simple transactions that do not require manual payment processing every billing cycle.

- Avoiding Late Payments: With automated systems, the risk of late payments diminishes, sparing customers from penalties or service interruptions.

- Enhanced Security: Compliance with PCI DSS (Payment Card Industry Data Security Standard) ensures the security of financial information.

The Role of Compliance in Recurring Payments

Ensuring compliance with industry standards, especially PCI DSS, is crucial for businesses handling sensitive financial data through recurring payment systems. Adhering to these standards not only protects customers but also establishes trust in the business’s commitment to security.

Exploring Interkassa for Reliable Recurring Payment Solutions

When delving into the world of recurring payments, businesses seek reliable solutions. Interkassa, a prominent player in the payment industry, offers a robust recurring payment system that aligns with the needs of modern businesses. Its features provide a secure and efficient framework for businesses and customers engaging in regular transactions.

Conclusion

In conclusion, the evolution of recurring payments signifies a shift towards efficiency, convenience, and security in financial transactions. Businesses embracing automated systems witness benefits such as consistent cash flow, increased efficiency, and enhanced customer retention.

For consumers, the advantages lie in convenience, avoiding late payments, and the assurance of secure transactions. As we navigate the digital age, the role of recurring payment systems, exemplified by solutions like Interkassa, becomes increasingly integral in shaping the future of financial transactions.